Source The Center For Strategic and International Studies

Media www.rajawalisiber.com – Military aircraft engine technology is a qualitative edge for the United States, enabled by a world-leading industrial base. The CSIS Defense-Industrial Initiatives Group (DIIG) have conducted additional research using recent contract data and newly released defense budgets to update their study of government investments in military aircraft engines.

The Issue

Military aircraft engine technology is a qualitative edge for the United States, one enabled by a world-leading industrial base. However, the U.S. Department of Defense (DOD) faces critical decisions regarding the future of engine investments and the industrial base of the F-35. This platform dominates present U.S. tactical aircraft purchases and faces a growing engine modernization imperative. The following questions help inform key debates: How does the DOD prioritize investments in engines compared to other systems? Where is investment targeted? And how can competition best be fostered?

Recent years have shown a spike in the purchase of products for military engines amid a decline in research and development (R&D) spending relative to the early 2000s. Military engine R&D is now largely dependent on the Air Force, as the Navy has taken a step back to focus funding on other service priorities. Finally, competition for military engine contract spending has been on the decline as the F-35, with its single-engine option, dominates the procurement landscape. The future of the military engine industrial base will be shaped by the DOD’s choice between spending more up front to introduce competition into the fifth-generation fighter fleet or waiting until the end of this decade as the first sixth-generation fighter is expected to enter production.

Introduction

Military aircraft engine technology and the industrial base underlying it have been a traditional area of strength for the United States. Advances in engine technology have underpinned the United States’ enduring strengths in air superiority. This technological advantage is not guaranteed and must be carefully nurtured for it to be sustained and maintained. In a 2021 report called The Future of Military Engines, the CSIS Defense-Industrial Initiatives Group argued that the DOD faced several difficult decisions regarding the development of military aircraft engines. These range from what technologies to prioritize, when and where to invest in military engine development, what business model to use when developing military aircraft engine contracts, and how to foster competition in this field. These policy choices are inherently multi-vectored, as each challenge impacts the others.

The United States’ comparative advantage in the military aircraft engine market relies on the engine industrial base. General Electric and Pratt & Whitney accounted for 70 percent DOD market share in 2020 and are supported by a wide ecosystem of suppliers. Rolls-Royce North America is also a major player in the market and is both a driver of innovation and a major supplier in several aircraft modernization programs, including for the B-52 and T-45. Other firms known for their work in adjacent fields such as Aerojet Rocketdyne and lower-tier subcontractors in the supply chain play a major role in sustaining the United States’ competitive advantage. The DOD strives to maintain an engine industrial base that fosters competition while also achieving scale and savings for the taxpayer. This is a harder balance to strike when a single system, the Joint Strike Fighter (F-35), with variants for the Air Force, Navy, and Marine Corps, dominates the demand for fifth-generation fighter engines. The F-35 reinforces winner-takes-all dynamics that were weaker in prior generations when the DOD fielded multiple third- and fourth-generation platforms with long active production lines.

The 2021 CSIS report included information on government investments in engines through 2018. These investments are critical because engine design plays a vital role in shaping each system’s operational capabilities and because the United States still maintains a sustainable comparative advantage in this field relative to other states. However, there are other investments that have critical importance for air superiority, including stealth, secure networking, and artificial intelligence capabilities. That means the DOD needs to balance spending among multiple priorities.

This update examines three policy choices regarding engine investments, updating the investments tracked in the 2021 report:

- What priority does the DOD place on the continuing development of fighter engine technology?

- Where is investment targeted in fighter engine development? The answer has two dimensions: (1) the stage of technology and (2) the generation of fighter aircraft.

- How can competition be fostered in the military engine industrial base?

Methodology

To address these questions, this brief turns to unclassified data to update the previous report with three additional years of contract data, for fiscal years (FYs) 2019 through 2021, as well as four additional President’s Budgets (PBs), for 2020 through 2024. All dollar figures in this brief use 2021 constant dollars as adjusted by Office of Management and Budget GDP deflators, and all years follow the federal FY unless otherwise noted. CSIS has created and updated a data set of prime contract spending on engines from the Federal Procurement Data System (FPDS) and has reviewed Air Force, Navy, and Army justification books to identify projects of interest. 1 Taken together, this budget and contract data allow for a revisiting of the state of military engines now that a five-year rebound in overall acquisition spending has culminated. This brief also incorporates new methodologies to better capture the range and diversity of military engine contract spending, which are described in greater detail in the project’s open-source data repository.

In addition to expanding the scope, these new methodologies include two notable changes in classification. First, the FPDS treats contracting for the F-35 Major Defense Acquisition Program (MDAP) as part of the Navy, but this brief instead treats this multi-service program as a separate customer to ensure that its prominence is clear. Second, FPDS product or service codes do not always align with DOD budgetary accounts, which can result in confusion. For example, not all research, development, testing, and evaluation (RDT&E) contracts are labeled as R&D, not all procurement contracts are labeled as products, and not all operations and maintenance contracts are labeled as services. This study overrides the FPDS’s classification of the most prominent military engine RDT&E project, the Adaptive Engine Transition Program (AETP), as primarily a product rather than an R&D contract. This brief instead includes FPDS R&D spending and identified AETP contracts under a single category called R&D and AETP.

How Much of a Priority Are Military Engines?

Spending data is a key metric for assessing the DOD’s priorities and often serves as the most direct indication of priorities—spending shows where the government is allocating its resources. Updating the prior research with the new categories finds that DOD engine contract obligations decreased by 6.9 percent from FY 2000 to FY 2017 before spiking to a $13.0 billion in FY 2018. Additionally, the DOD de-prioritized R&D spending as opposed to product spending from FY 2010 to FY 2018, dropping 42 percent even with the inclusion of the AETP. Turning to more recent years, as shown in Figure 1, both products and R&D obligations further grew in FY 2019 before returning to earth from FY 2019 to FY 2021. The rise and fall of product spending can be directly traced to the lumpiness of contracting for engines for the F-35. However, while R&D spending has been similarly tied to the AETP, unlike products the peak of R&D at 1.06 billion in FY 2019 was below spending levels from FY 2001 to FY 2010.

Figure 1 offers valuable insight into the DOD’s procurement patterns for military aircraft engines over the past two decades. Noticeably, R&D obligations significantly declined in FY 2011 as the F135 engine shifted from the R&D phase into production. The DOD’s FY 2021 R&D obligations were $812 million, a decline of 44 percent from the FY 2010 high of $1.45 billion. The DOD’s R&D obligations from FY 2012 to FY 2021 were buoyed by the AETP and its predecessor, which contributed $3.6 billion to DOD R&D obligations during this period. GE reported that it completed its major objectives and is ready to “transition to an engineering and manufacturing development programme” if DOD proceeds with their design. As R&D obligations decreased from FY 2010 levels, services obligations experienced a similar decline before surpassing $2.2 billion in FY 2017 and stabilizing. The early rise in services spending coincided with the 2001 quadrennial defense review call for increased responsibility for vendors on sustainment via performance-based logistics contracts. The peak in obligations for services in FY 2010 may have been driven by the stress on military engines driven in large part by operations in Iraq and Afghanistan. The rise of service spending in FY 2017 is just part of the story for engine sustainment, as products spending includes spare parts, some performance-based logistics contracts, and replacement engines. DOD product obligations in FY 2019 are a noticeable outlier in the data and reflect $3.1 billion in spending related to definitizing the contract for engines for the F-35 lots 12 and 13. Including the 2019 spike, F135 engines are responsible for $23.2 billion in products contracts in the past 10 years.

Switching from contracting for R&D to budgets for RDT&E, Figure 2 shows why Air Force decisions will be so critical for the future of military engines, even more so than in recent years. The F135 and F136 engines drove spending for both the Air Force and the Navy, with the Air Force reaching peaks of $1.23 billion in FY 2006. For the Air Force, spending had markedly declined during the budget cap period, declining by 32 percent from FY 2013 to FY 2015. Spending recovered during the buildup, peaking in FY 2019 at $1.10 billion, a substantial amount but below the earlier peak.

The higher spending levels reflect that the Air Force has long served as the primary financier of engine-related R&D programs in a bid to improve the capabilities and affordability of propulsion technology. The Integrated High-Performance Turbine Engine Technology (IHPTET) program, which ran from 1987 to 2005, set the scene for engine R&D in the twenty-first century. IHPTET was a joint DOD and NASA (National Aeronautics and Space Administration) effort that aimed to double the thrust-to-weight ratio of military aircraft engines to create the “ultimate turbine engine.” After IHPTET concluded, the Versatile Affordable Advanced Turbine Engine (VAATE) began in 2006 to improve the thrust-to-weight ratio and reduce fuel consumption by 25 percent. Though VAATE is ongoing , it spawned the Adaptive Versatile Engine Technology (ADVENT) program in 2007 followed by the Adaptive Engine Technology Development (AETD) program in 2012 and the AETP in 2016.

The adaptation in ADVENT and AETP is seeking to harness the efficiency of commercial engines to meet performance demands of military aircraft and draw on their respective strengths depending on the needs of the warfighter. ADVENT developed key technologies that would allow future engines to improve fuel efficiency and thrust by varying the engine’s bypass ratio. As a result, both AETD and AETP endeavored to transition from an early technology program to developing a useable engine design. For AETD, the DOD awarded both GE and Pratt & Whitney $213.6 million to develop a three-stream engine to deliver on VAATE’s objective to reduce fuel consumption by 25 percent. The DOD awarded these firms over $1 billion in 2016 to continue their AETD work under the auspices of the AETP.

Adaptive engines are the principal driver of new RDT&E spending. The engines produced by both firms with the AETP are designed to potentially replace the F-35’s F135 engine. In parallel, the Next Generation Adaptive Propulsion (NGAP) program, which was first funded in FY 2019, is part of the sixth-generation Next Generation Air Dominance (NGAD) program. The NGAD is a classified program to deliver a successor to the F-22 . NGAD has the goal of fielding an inhabited aircraft by 2030, although it has not yet matured to the point of reaching milestone B , a gateway in the acquisition process prior to a larger commitment of development resources. However, this level of spending is dependent on future years’ money beyond the PB request. There is a 37 percent decline from FY 2021 actual spending to the $623 million FY 2023 request. Planned spending levels quickly recover thereafter, but much of this planned increase likely assumes that the DOD funds a transition engineering and manufacturing development, a decision that has not yet been made.

At the start of the century, the Navy stood alongside the Air Force as a major contributor to military engine development, spending $600 million or more every year from FY 2002 to FY 2010 and peaking at $938 million in FY 2003. By comparison, the Navy has not spent more than $200 million annually since FY 2015, although spending on its sixth-generation fighter is classified. The Navy spent $122 million in FY 2021 and only requested $126 million in PB 2023, with slightly lower spending throughout the rest of the Future Years Defense Program (FYDP). Much of this funding goes to the Aircraft Engine Component Improvement Program (CIP), which supports incremental improvements for multiple naval aircraft and is larger than the comparable programs in the other two services. Even with the marked decline in Navy RDT&E, that service accounts for 30.5 percent of the spending from FY 2000 to FY 2021 for which actual spending amounts are available.

Army spending has been a growing contributor due to the Improved Turbine Engine Program, which is planned to peak in FY 2022 at $260 million. This project supports a next-generation turboshaft engine for the Black Hawk, Apache, and planned Future Attack Reconnaissance Aircraft. According to Army justification books, this program “replaces the existing T700 engine design originated in the 1970’s.” The decline in funding tracks with a move to testing and integrating these new engines. Low-rate initial production is anticipated to begin in FY 2025.

While the upper charts in Figure 1 and Figure 2 focus on spending in absolute terms, the lower charts evaluate whether military engines are a priority by looking at relative spending. As seen in Figure 1, comparing the FY 2000–FY 2003 period to the FY 2019–FY 2021 period, products have declined as a proportion of topline spending in their respective categories and as a percent of aircraft spending. Meanwhile services grew as a percentage of both measures. The decline in military engines as a proportion of Air Force and Navy RDT&E shown in Figure 2 is stark. While these shifts are cyclical and may change with investments in the sixth generation of fighters, the Navy appears to be content to have unclassified investments driven primarily by the Air Force. The implications of sixth-generation fighters on the products side may be smaller than that of the F-35. The Air Force’s estimate that each NGAD will cost several hundred million dollars suggests that unit counts will be lower even when supplemented by more affordable uninhabited aircraft.

Where Is Investment Targeted in Fighter Engine Development?

Regarding prioritization and resource allocation, The Future of Military Engines argued that the military aircraft engine industrial base is further challenged by the evolving nature of aircraft development. The report argued that the DOD is balancing the priority placed on engine R&D and other emerging technology R&D. Additionally, the United States’ comparative advantage in the development of military aircraft engines means that the DOD is in a position to make investments to capitalize and sustain its advantage rather than needing to make investments in fundamental research and industrial capacity.

Figure 3 provides additional detail on the breakdown of product, service, and R&D spending for each of the military departments. Two points stand out. First, F135 engines are increasingly dominant in product spending for military engines, accounting for an average of 39 percent of obligations from FY 2019 to FY 2021. It is important to remember that the larger products category includes spending for new engines, support contracts, and supplies and spare parts. For example, while the F-35 reports no service contracts of note, its product contracts include performance-based logistics contracts and spending on sustainment, which accounts for $1.9 billion and $416 million of spending in the period. The rise in F-35 MDAP spending is influenced by sustainment challenges for the F135 engine, with the GAO reporting that “an increasing number of F-35 aircraft have not been able to fly due to the lack of an operating engine.” That same report found that the annual sustainment costs for F135 engines were $315 million in FY 2020 and that “engine sustainment costs have increased from 7 percent of the total in fiscal year 2016 to 11 percent of the total in fiscal year 2020.” F135 sustainment costs rising faster than initially planned would be captured in this spending. Second, service contracting, which predominantly addresses sustainment, is growing as a proportion of engine expenses after a period of decline earlier in the previous FY, accounting for nearly $2.3 billion in FY 2021, the highest level since FY 2012. This underlines why investments that improve sustainment performance and reduce life-cycle costs merit significant attention.

The most important contract not covered in Figure 3 is for the NGAP project. The indefinite delivery contract for NGAP was awarded in FY 2022 to five vendors: Boeing, GE Aerospace, Lockheed Martin, Northrop Grumman, and Pratt & Whitney. The majority of the work is expected to go to GE Aerospace and Pratt & Whitney, with the other companies having an important but smaller integration role as they compete to provide the airframe.

What Are The Priorities within Military Engine RDT&E

The top-funded Army, Air Force, and Navy RDT&E programs for aircraft engines are vital leading indicators for present and future allocation of resources for military engines. The budgeting trends are shown in Figure 4, which breaks out the top-funded program elements, and Figure 5, which shows spending by the stage of research. These stages of research, known as RDT&E budget activities, are numbered from 6.1 to 6.8, and for the codes shown in Figures 5, 6.1–6.5 and 6.7, larger numbers signify a greater level of technological readiness. Focusing on fighter jets in particular, the 2021 Future of Military Engines report identified three broad priority choices available for the DOD: (1) investing in 4.5-generation fighters and upgrading the engines on older systems to extend their lifespan and improve their utility; (2) focusing on the stealthy fifth generation of fighters, primarily the F-35, which while still early in its service life will require a propulsion modernization decision; and (3) looking forward to the sixth generation of fighter aircraft, which will allow for a greater leveraging of new technologies but only at an initial operating date still years in the future.

Across the DOD, the highest spending priorities from PB 2000 to PB 2023 have been for engines for fifth-generation aircraft, namely the F135 and F136 engines for the F-35. In Figure 5, both the F135 and F136 research fall under (6.5) System Development & Demonstration. Research on the F135, produced by Pratt & Whitney, now a subsidiary of Raytheon Technologies, accounts for over $11.9 billion in actual spending. General Electric’s F136 accounted for $3.7 billion in R&D spending but lost funding in 2011 after the DOD decided to procure only one of the two models and Congress ceased funding the alternative engine program.

The Air Force’s attention is increasingly focused on fifth- and sixth-generation fighters, although a pivotal decision as to whether to go forward with the AETP remains, which will determine the mix of fifth- and sixth-generation platforms. This can be seen in part in the Air Force’s CIP, which accounts for $3.7 billion in actual spending from FY 2000 to FY 2021 but only $225 million in planned spending from FY 2022 to FY 2027. This program supports a range of aircraft, including the B-21 bomber, the fourth-generation F-15 and F-16, and the fifth-generation F-22, which has ceased production. This research to incrementally improve established platforms falls under (6.7) Operational System Development in Figure 5.

However, the Air Force’s major investments in the coming years, namely the AETP and the increase in the NGAP program, are in more cutting-edge technology and thus fall under (6.4) Advanced Component Development & Prototypes. The AETP and NGAP programs are planned to be the next area of focus for the Air Force, with $3.4 billion in actual spending and another $4.0 billion planned from FY 2022 to FY 2027. Air Force secretary Frank Kendall has indicated that in the process leading to the PB 2024 he intends to commit to eventually procuring engines derived from the AETP or to end the program rather than let it proceed into the next stage of development. Planned spending may thus prove an overestimate; planned funding for the AETP may in the end be reprogrammed to support other Air Force priorities rather than further boost the NGAP. Both programs focus on adaptive engines, which are an entirely new category of engine technology that has been developed to the prototype stage. The AETP-derived engines could be employed in present fifth-generation systems, notably the Conventional Take-Off and Landing (CTOL) system and the Carrier Variant (CV) variants of the F-35, although the latter would require modifications to the air frame. However, the practicality of deploying these engines for the Marine Corps’ Short Take-Off and Vertical Landing (STOVL) variant is a subject of some dispute. The NGAP program is more focused on the sixth-generation fighter, which can be designed from the beginning to fully exploit its capabilities. As was raised in the prior section, if the AETP does not go forward, that would represent a significant reduction in priority of R&D for military engines.

Of the three military departments, the Air Force is most responsible for earlier-stage research, as seen in the second and third columns in Figure 5. Projects for Materials for Structures, Propulsion, and Subsystems and Turbine Engine technology fall under (6.2) Applied Research. As these technologies mature and are further integrated into present and future systems, programs such as Aircraft Propulsion Subsystems Integration are moved into (6.3) Advanced Technology Development. Applied Research and Advanced Technology Development accounted for nearly $4.6 billion and $2.6 billion, respectively, in actual spending from FY 1998 to FY 2021. The Air Force’s orientation toward next-generation technology is demonstrated by planned spending for these two categories, $898 million for Applied Research and $367 million for Advanced Technology Development, which both individually exceed the proposed spending for Operational System Development.

The Navy focuses its unclassified research efforts on fifth-generation fighters and the other aircraft in its fleet. The CIP for the Navy accounts for $1.7 billion in actual spending, smaller than for the Air Force, but is a larger priority going forward, accounting for $604 million from FY 2022 to FY 2027. The Army and the F-35 have CIPs as well, but those projects are smaller than the Air Force and Navy ones shown in Figure 4. Between the CIP, support for the Marine’s AV-8B Harrier, and other Navy support for operational systems, the Navy plans to spend $126 million in PB 2023 and at least $106 million for each of the out years. The Navy is also researching a sixth-generation fighter, which started “concept refinement” in 2021, but even the funding line for that effort has been classified for the past three years.

The Army engages in some early-stage engine research, partially because its fleet of rotorcraft involves different technologies than those used by the Air Force. However, total actual spending across the first three phases of R&D, from basic research to advanced technology development, is limited to $452 million, with another $142 million planned. The Army’s largest project is the improved turbine engine in the Operational System Development category. While this program does support the Black Hawk and Apache, it also serves the planned Future Attack Reconnaissance Aircraft. This program is planned to peak in FY 2022 at $247 million, part of a total planned $921 million in spending from FY 2022 to FY 2027.

What Competition Is Available for Military Engines?

Competition policy has been a hotly debated topic in military engines, with the F-35 fighter accounting for growing proportions of the Navy and Air Force’s tactical air fleet and spending.

The F-35 historically spurred competition between major engine manufacturers. In August 2005, the DOD awarded General Electric and Roll-Royce $2.4 billion to develop the F136 engine for the F-35 to rival Pratt & Whitney’s F135 engine. Though the JSF’s 1996 acquisition strategy called for a competitive engine acquisition program, the DOD procured the F135 engine and originally planned to develop an alternative a few years later. Despite this plan, the DOD attempted to kill the F136 program in 2007 and 2008 only for Congress to reject these proposals. At the time, Congress remained skeptical of giving a single company a monopoly on the F-35’s engine and believed that with two engines the DOD could retain flexibility in case problems arose within either engine.

For economies of scale and cost reasons, the DOD decided not to attempt a rematch of the great engine war in which competing models for fourth-generation fighter engines were sustained through production. This allowed for competition longer into the life of those platforms, which has the potential to lower costs; analyst Jeremiah Gertler found that in the past engine competition improved “contractor responsiveness,” (e.g., “better contract terms and conditions, better warranties to assure engine quality, consistency, and long term stability of support.”). Responsiveness can be valuable accelerating the pace of engine improvements such as addressing the range of CTOL variant, which was below threshold as of December 2010. Costs for the F135 had already risen by 24 percent in July 2009 due to quality control issues. Then secretary of defense Robert Gates found the increases “quite manageable” given the risks in aircraft development and in 2010, Gates urged President Barack Obama to veto any bill that funds the F136 engine. On May 19, 2010, Gates said that his idea of competition is “winner takes all,” and Air Force chief of staff Norton Schwartz testified “the reality is that the F-22 and the F-18E/F are single-engine airplanes. And, you know, there’s no dispute about that, and it’s because we collectively in the defense community, I think, have become comfortable with the reliability and so on of those respective engines, one of which is a predecessor to the 135.” Gates succeeded in cutting the F136 engine’s funding in FY 2011 and leaving the F135 as the sole engine for the F-35.

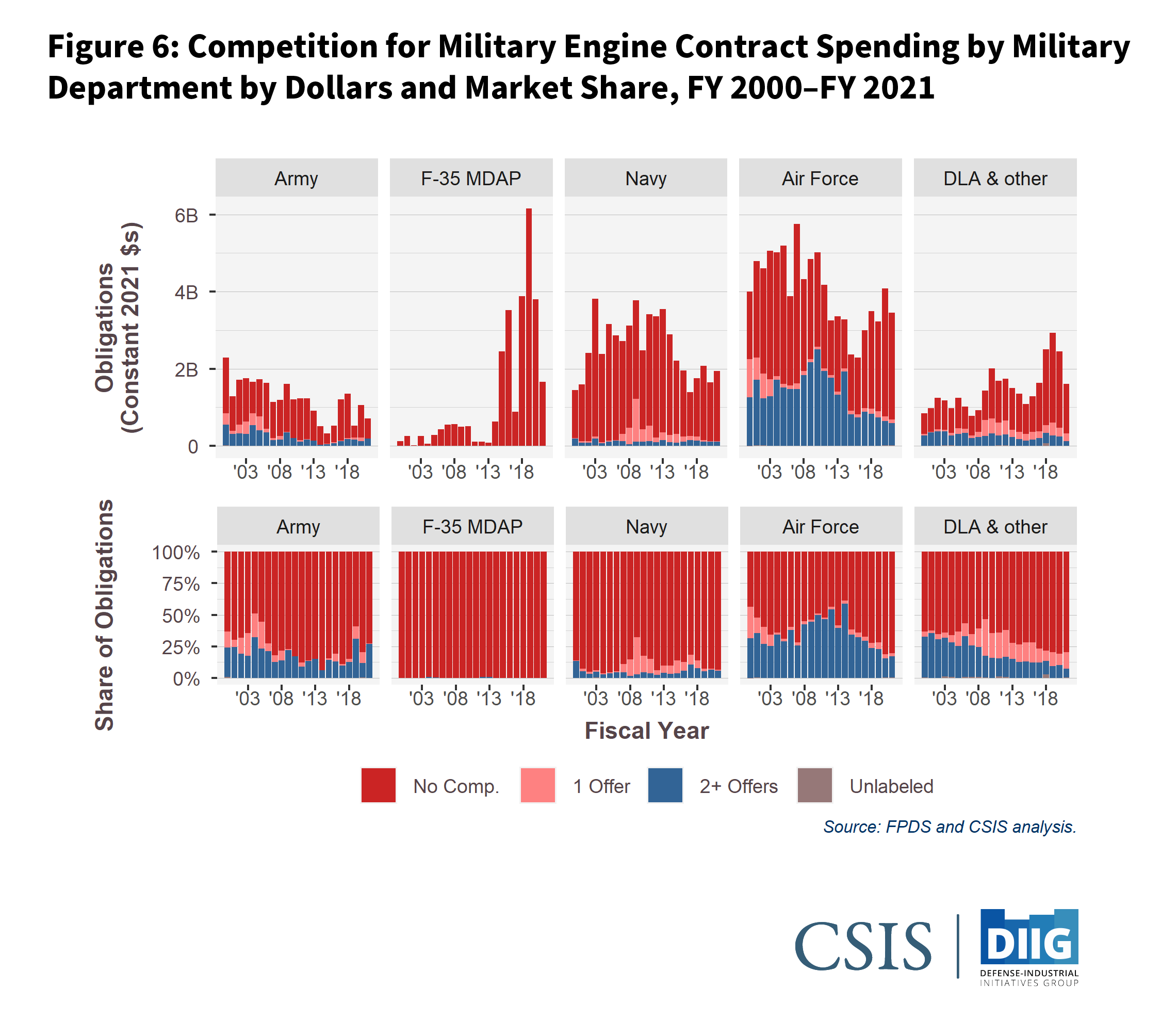

The downside of that decision can be seen in Figure 6, as shown in the absence of competition for the F-35 and the decreasing share of contract dollars receiving multi-offer competition for both the Navy and Air Force as well as the remainder of the DOD.

The DOD now faces a critical new choice of whether to incorporate adaptive engine technology into fifth-generation fighters. The choice of how to modernize the F-35 engine will be shaped by the desire to upgrade performance, address greater than expected demands placed on the engine, and find the best deal as sustainment costs mount. In 2021 the GAO argued that “challenges related to F-35 engine sustainment are currently affecting the program and may pose its greatest sustainment risk over the next 10 years.”

The AETP and preceding programs fostered competition between General Electric and Pratt & Whitney to design a new era of fighter engines with an eye toward the NGAD and the future of the F-35, resulting in prototypes from both companies. One option would be to use adaptive engines for the CV or CTOL variant, with STOVL F-35s retaining their original F135 power plants. Another approach would be incremental improvements to the existing engine, resulting in less capability than the AETP engine option. The DOD spent over $3.2 billion from FY 2012 to FY 2021 to fund General Electric and Pratt & Whitney’s efforts to design a prototype engine for the F-35 as a component of the AETP. If adaptive engine technology is not procured for the F-35, the DOD is guaranteed to have a sole major engine vendor for the F-35 for the foreseeable future.

The new adaptive engines offer a 25 percent gain in fuel efficiency, a 30 percent range increase, and a doubling of power and heat management capability. The latest technologies for new engine design as well as investments made by other nations, notably Russia and China, will be discussed in subsequent briefs in this series. In the meantime, cost and the health of the industrial base have been prominent factors in this debate. John Sneden, the head of the Air Force’s Propulsion Directorate, warned that “a portion of the industrial base would begin to collapse. . . . If we end up with one vendor there, if we don’t move forward with AETP, that vendor can actually get us into a place where we have, essentially, a reduced advanced propulsion industrial base.”

In contrast to clear concerns around the strength of the industrial base, other Air Force leaders have argued that the cost of either switching to or adding an additional power plant would require trade-offs that could imperil other budgetary priorities. This topic has also lead to dueling arguments in Congress: a bipartisan group of 49 congressional legislators signed a letter directed to Defense Secretary Lloyd Austin on October 7, 2022, urging the DOD to fund next-generation propulsion and work to “deliver adaptive technology to the services.” Conversely, on July 22, 2022, 36 bipartisan congressional legislators sent a letter to Under Secretary of Defense for Acquisition and Sustainment William A. LaPlante urging the DOD to not move forward with the AETP engine, citing the existing F135’s performance and reliability and the cost of moving forward with the AETP engine. They instead pointed to modernization via the Enhanced Engine Package. Whatever choices are made will be critical for the industrial base for the coming years in the period before the sixth-generation NGAD enters production, which is anticipated by the end of this decade.

Future engine competition may also draw from sources rather different than the fighter industrial base, such as those used in rockets or for uninhabited aerial vehicles. One recent competition was the Air Force’s effort to replace the aging engines across its B-52 fleet. The B-52 Commercial Engine Replacement Program (CERP) was able to use commercially derived systems because of the nature of the B-52 mission and airframe. This gave the Air Force greater flexibility in selecting a vendor by reducing the RDT&E burden. After stiff competition from across the major manufacturers, the Air Force awarded the contract to Rolls-Royce.

In recent years, the DOD has expanded its ability to employ Other Transaction Authorities (OTAs), a flexible mechanism first employed by NASA that is geared toward quick prototype development, which was more difficult in the traditional defense acquisition system. This mechanism can draw both from nontraditional defense vendors and companies that have made significant investments in the research they are bringing to the DOD.

CSIS analysis of OTA data showed that the Defense Advanced Research Projects Agency (DARPA) is the main contracting agency awarding OTAs for military engines. One such initiative is the Advanced Full Range Engine (AFRE). The AFRE, developed by Aerojet Rocketdyne under the terms of a $65.1 million transaction, is a turbine-based combined-cycle engine concept, meaning it is the combination of a turbine engine and a dual-mode ramjet. This innovative engine would allow for routine hypersonic flight with reusable aircraft via a propulsion system that can operate over the full range of speeds from low-speed takeoff through hypersonic flight. Another DARPA OTA is a 2015–2019 $6 million Rotary Combustion Engine project, developed by LiquidPiston. The Air Force has also made use of OTAs, awarding SOCCEC $29.6 million to develop the B-52 CERP.

The case of the AFRE points to the sort of ambitious approach to hypersonic flight that OTAs are potentially well suited to prototype. That said, even if the Fuel Efficient, Light-weight, Heavy-fueled Rotary Combustion Engine and CERP do not appear to be revolutionary concepts, they are examples of building out the military engine industrial base and bringing in new approaches to technology. However, across their lifetimes, these leading OTAs together account for well less than a single year of R&D contracting for military engines. This difference shows that OTAs may be a source of promising new technologies but do not operate on the same order of magnitude as decisions like the program to maintain a second for the F-35 engine or to adopt fifth-generation adaptive engine technology.

Final Thoughts

This update shows that trends in investments in engine technology identified in CSIS’s 2021 report, The Future of Military Engines, have continued. Product spending on the F-35 has increased, and overall R&D spending on military engines has remained at a lower level and will be highly dependent on the NGAP and the decision of whether to go forward with an adaptive engine for the fifth-generation fleet. Prioritization for military technologies is typically cyclical, but the winner-takes-all nature of the F-35 as the dominant tactical air platform combined with the earlier choice to fund only one family of engines will continue to shape the competitive health of the military aircraft engine industrial base for years to come by reducing the opportunities for competition. The present course leaves the DOD, and the Air Force in particular, with a choice. Budget constraints often prevent the funding of all desirable investments and can foreclose future growth options; therefore, decisions must be made over which technologies take priority. One option would be to determine that other technologies are more important, to accept an upgrade to the current F135 as capable for the future of the aircraft, and to accept the risk to the industrial base and supply chain. Another possibility would be to move forward with an AETP engine and pay up front to place a greater priority on engines in exchange for receiving technological benefits earlier, maintaining a more competitive industrial base, and potentially lowering life-cycle costs. If the DOD chooses not to proceed with repowering the F-35, it should still take steps to protect the health of the advanced engine industrial base to ensure that there are multiple strong competitors for future generations of tactical aircraft.

Gregory Sanders is the deputy director and a fellow of the Defense-Industrial Initiatives Group at the Center for Strategic and International Studies (CSIS) in Washington, D.C. Nicholas Velazquez is a research intern with the CSIS Defense-Industrial Initiatives Group.

This brief is made possible by support from General Electric Aerospace and general support to CSIS.

CSIS Briefs are produced by the Center for Strategic and International Studies (CSIS), a private, tax-exempt institution focusing on international public policy issues. Its research is nonpartisan and nonproprietary. CSIS does not take specific policy positions. Accordingly, all views, positions, and conclusions expressed in this publication should be understood to be solely those of the author(s).